INVESTING MADE SIMPLE

One of the great benefits of automatic enrollment is that it simplifies decision making. The initial rate at which you contribute and the way your money is invested are set. Choices like that, especially if you’re making them for the first time, can be intimidating. And if you’re afraid of making a mistake, you may decide it’s easier to do nothing about investing—which is the worst choice you can make.

But it’s also good to know that with the BRS, you’re not locked in to either the default contribution rate or investment choice. You have the right to contribute at a higher or lower rate. Of course, if you want your account value to grow larger, higher is the way to go. Similarly, if you would rather put your money into the individual funds offered in the TSP, you can make the switch whenever you’re ready.

TSP INVESTMENT CHOICES

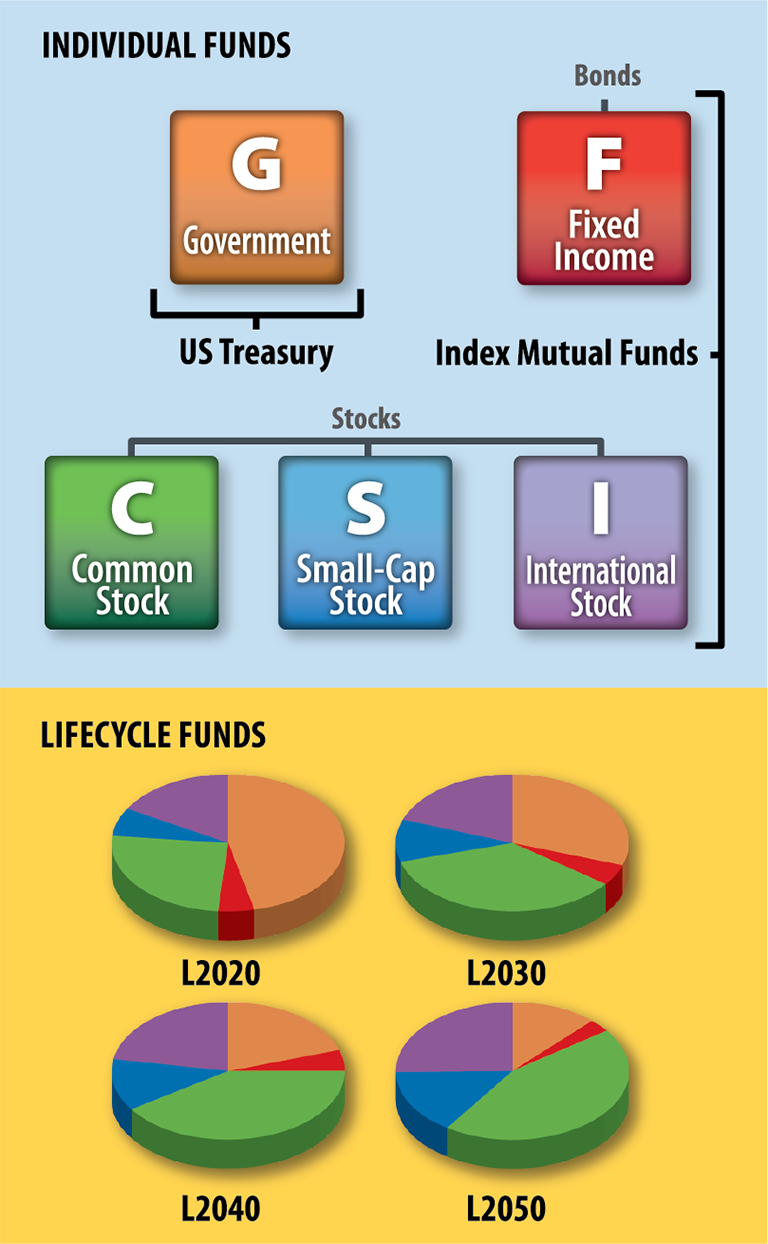

If you stick with the default investment, your contributions plus the automatic 1% and the matching contributions from DoD you’ll qualify for after completing two years of service will go into a lifecycle (L) fund, called the L2050. It’s one of a series of L funds, now including L2020, L2030, and L2040 and eventually L2060.

If you prefer to use one or more of the five individual investment funds (G, F, C, S, and I), the contributions will be allocated to them on the percentage basis you have designated.

The G (for government) fund invests in a portfolio of US Treasury securities.

The other four funds (F for Fixed Income, C for common stock, S for small and mid-sized company stock, and I for international stock) are index mutual funds. An index fund is designed to mirror the performance of a specific stock or bond index by owning all, or a representative sample of, the securities in the index.

The L funds, which are funds of funds, include all five individual funds in a single package. But each L fund holds the five funds in different proportions, or weights. For example, the L2050 fund has 84% of its assets in stock funds, while the L2020 fund has just 41% in stock funds.