If you’re serious about meeting your financial goals, you need to make strategic investment decisions.

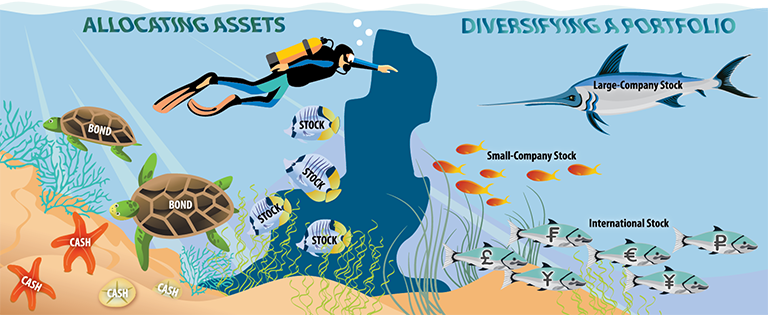

You can start by allocating your portfolio, which means dividing your principal among different categories of investments, usually on a percentage basis. The core categories, called asset classes, include stocks and stock funds, bonds and bond funds, and cash equivalents. Each asset class shares a set of defining features that distinguishes it from the others. For example, all stocks and stock funds give you equity in the company issuing the stock.

As a next step, you diversify, or achieve variety, within each asset class. That’s important because smaller categories within each broad asset class typically behave differently from each other even though they all share the defining features of that class. For example, all bonds mature after a specific number of years. But bonds with one-year terms are much less vulnerable to inflation than bonds with 30-year terms.

TURNING THEORY TO PRACTICE

If you’re ready to move ahead with your investment strategies, it’s smart to take your age into account. The younger you are, the larger the percentage of your total contribution you may be comfortable putting into stock funds, perhaps 80% to 90%. The next step is to divide the total among the three TSP stock funds: large-company US stocks (C), small and medium-sized company US stocks (S), and international (I) stocks.

The ratio you use is up to you. You might start by the L2050 fund as a model: It has 44% of its assets in Fund C, 15% in Fund S, and 25% in Fund I.

That means each pay period, 44% of your contribution and 44% of the DoD contribution will go into Fund C, 15% of each into Fund S, and 25% of each into Fund I. And it’s worth repeating that unless there’s a compelling financial reason, you’ll want to contribute at least 5% of your base pay to qualify for the full match that begins at the start of your third year of service.

Remember, though, that you’re not locked into your choice. You might assign equal percentages to each of the three TSP funds or use some other allocation. As you become a more experienced investor, you can easily change the equity portion of your portfolio as well as your overall allocation. One thing you don’t want to do, though, is to try to outsmart, or time, the market by shifting money among your funds based on speculation about what will happen next. That’s a losing game.