SHIFTING THE FOCUS

An L fund’s portfolio is typically adjusted in a gradual, planned reallocation four times a year, at the end of each quarter. The fund is also rebalanced each business day to ensure its assets are in line with the allocation it intends. Rebalancing occurs in response to changes in market conditions, such as an exceptionally strong stock market performance or an increase in interest rates.

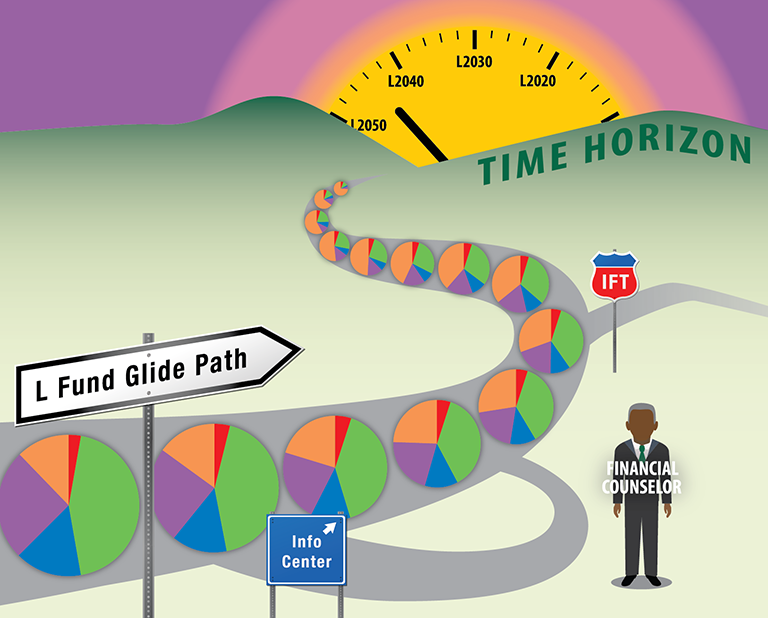

The pace of the reallocation is known as the fund’s glide path and determines the allocation at the designated, or target, date.

The logic for adjusting the allocation is that a stock-heavy portfolio, even if it is well diversified, as is the case with C, S, and I funds, tends to be more volatile than a portfolio with larger allocations to the G and F funds. Volatility increases the risk of your account losing some of its value, especially in the short term. That becomes less and less appealing as the time you’re planning to start withdrawing from your account approaches. That’s why L funds shift their allocations over time away from stocks and into government funds.

But you have to remember that returns on government securities, while not volatile, expose you to inflation risk and the possibility of inadequate income. The longer you live in retirement, the greater this risk becomes.

BEYOND THE TARGET DATE

When your retirement is years in the future, one question you may not think to ask is what happens when your L fund reaches its target date. The answer is that it converts to an income fund and keeps your assets invested as you and other fund owners withdraw money over time.

For example, the current TSP Income fund, formerly the L2010 fund, has 80% of its assets in fixed income and government securities and 20% in stocks. Even more conservative lifecycle funds eliminate stock holdings entirely at the target date. On the other hand, some more aggressive lifecycle funds maintain substantial stock holdings for 30 years or more beyond the target date, only gradually reducing the allocation to 20%.

It’s an important difference, since the way a fund is invested has a major impact on the amount that’s likely to be available each year for the rest of your life.

MAKING SMOOTH MOVES

If you change your mind after investing your assets, you can move money out of an L fund and into individual TSP funds at any time by making an interfund transfer (IFT) request. The only exception is that after you’ve made two IFTs in a month, additional transfers in that month must go into the G fund. However, making multiple changes in quick succession rarely if ever improves the performance of your portfolio.

Transfers work the other way as well. If you allocate your contributions to individual funds when you begin to contribute to your TSP account, you can always move your account balances into an L fund at any point in your career.

Any transaction fees you incur for an IFT are nominal, unlike the high fees and significant penalties charged by some other retirement investments you may be offered, such as fixed, variable, or index annuities.