A MUTUAL FUND OVERVIEW

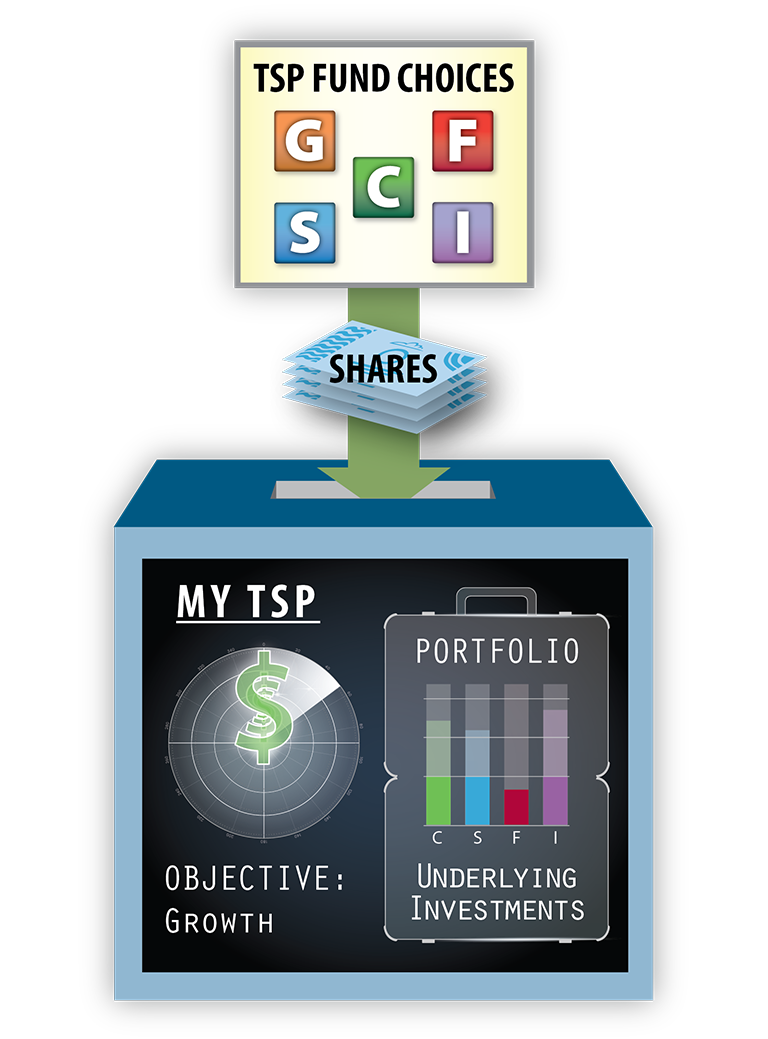

Like most defined contribution plans, the TSP offers a menu of funds as its investment options. So it’s important to understand how these — and other — mutual funds work. That’s easier than it sounds since they’re basically all alike in several key ways.

Each mutual fund owns a portfolio, or collection, of individual stocks or bonds called its underlying investments. In each case, these underlying investments have some specific features in common. For example:

- TSP Fund C owns stocks of big, well-known companies like Apple and Nike.

- TSP Fund I owns stocks of big companies like Toyota and Nestle with headquarters located in other countries.

- TSP Fund F owns bonds issued by corporations, state and local governments, mortgage-backed securities, and the bonds of other countries that have been issued in the United States.

Each fund has an investment objective, which is the goal the fund is designed to achieve. The portfolio is selected to meet the objective. For example, the objective of TSP Funds C and I is growth in investment value.

BUYING SHARES

Each fund sells its shares to interested investors. Typically, a fund issues as many shares as investors want to buy and buys back any shares investors want to sell. The price per share, called the fund’s net asset value (NAV) is calculated at the end of every trading day. All buy and sell orders the fund has received during the day are fulfilled, or executed, at that NAV.

As a TSP participant, you accumulate shares in either the L fund or the funds that you have selected. That happens when the combined contributions from your pay and the DoD is used to buy shares in your name each pay period.

If the combined contribution is enough to buy ten shares of a particular fund, those ten shares are added to your account. This process repeats each pay period, though the actual price of each share can change over time. So, in a hypothetical case, if you bought ten shares in each of 24 pay periods, at the end of a year your account would have 240 additional shares.

Each fund distributes, or pays out, to its investors the earnings that its portfolio investments generate. This includes either dividends or interest as well as any gains the fund realizes from selling its investments for a profit.

When you own a mutual fund in a retirement account like the TSP, these earnings are always reinvested to buy additional shares. Over time, your share holding can grow substantially.