The Blended Retirement System (BRS), which launched on January 1, 2018, retains the strengths of a pension-based system while adding a robust defined contribution plan that actively encourages — and also rewards — saving for retirement.

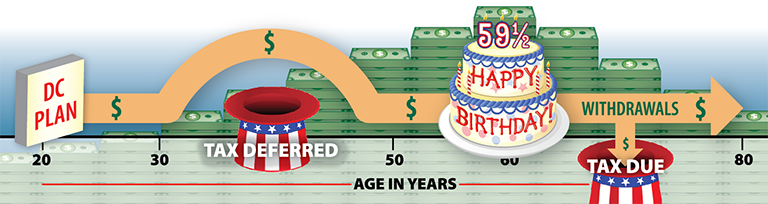

TAX-DEFERRED GROWTH

In all DC plans, the money you and your employer contribute to your account compounds tax deferred. This means no tax is due on your earnings until you begin withdrawing from the account years later. At that point, you pay tax on the withdrawals at the same rate you pay on your other ordinary income. When taxes are deferred, earnings can accumulate faster since money you would otherwise have to use to pay taxes can keep growing in your account. The only downside is that earnings in a DC account aren’t guaranteed. This means in some years the value of your account may be flat or even shrink. But over the long term, you can expect compounding to help your account grow larger, potentially substantially larger.

There is, however, a trade-off for tax deferral. With few exceptions, you give up access to your account value until you’re at least 59½. If you withdraw earlier, the tax you’ve deferred is due when you file your tax return for that year. You’ll also owe a 10% tax penalty. That’s because tax deferral is an incentive to save for retirement. So if you use the money for something else, it will cost you.

There’s another concession you make for tax-deferred growth: You must begin withdrawing from your TSP or other DC account when you turn 70½. If you don’t, you’ll face significant penalties.