RISK AND RETURN

As you make investment choices, it also helps to understand the direct relationship between risk and return. As with other things in life, the more risk you’re willing to take, the greater the return it’s possible to achieve.

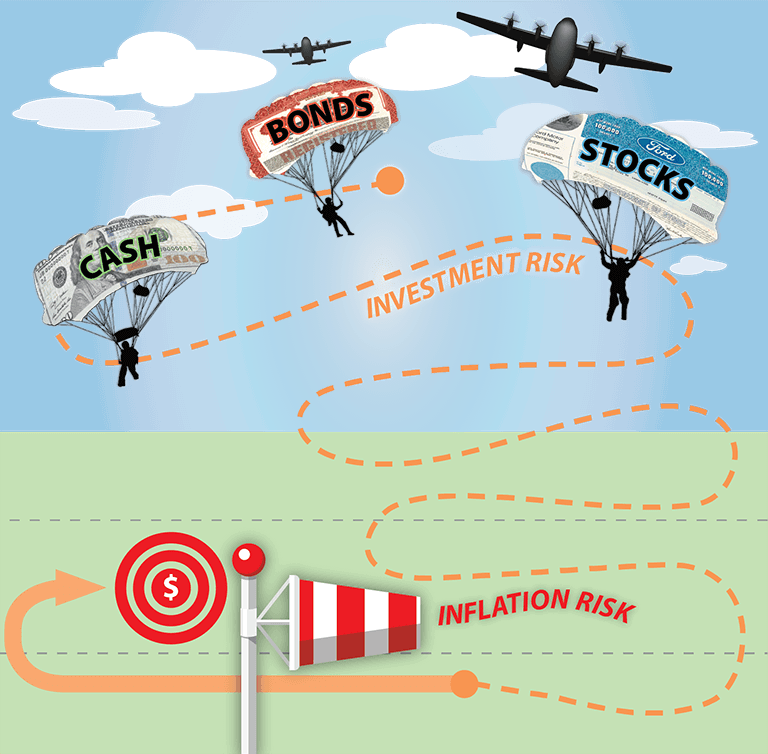

For example, stock and stock funds tend to expose you to more investment risk—meaning the possibility of losing money—than either bonds or cash, primarily because stock prices can be volatile. This means they can change quickly and sometimes dramatically, which bond prices don’t tend to do. But stocks and stock funds as a group—though not every individual stock or fund—have a long-term average annual return that’s significantly higher than either bonds or cash have produced. That means their value grows at a faster rate than either bonds or cash.

Another type of risk, called inflation risk, is a greater problem with cash equivalent investments and fixed-income investments that pay a low rate of interest. In this case, you don’t lose money but your money loses its buying power because your investment earnings don’t keep up with inflation, or the regularly increasing cost of goods and services.

WHY WAIT?

What keeps many people from achieving their financial goals is fear of losing money if they invest. All investments do, in fact, carry some risk.

For one thing, a gain on amounts you invest, which is called your return, isn’t guaranteed, as interest on a certificate of deposit (CD) or savings accounts is. Return can actually be negative in some years.

But you have to balance this possibility against the long-term history of positive results provided by stocks, bonds, and cash equivalents. While it’s true that past performance doesn’t guarantee future returns, you can be sure that if you don’t put your money to work by investing it, it won’t grow quickly enough to meet your goals.

THE AGE FACTOR

When you make investment decisions, your goals are a major factor, but so is your age. The younger you are, and the longer you have until you’ll reach retirement age, the more investment risk you may want to take. In your TSP account, this means emphasizing stock funds, specifically the C, S, and I Funds or opting for the L2050 fund.

- The added risk is offset by the potential to increase your return, which builds the value of your account.

- Equally important, you can afford to take the greater risk because you have a long time to make up for any negative returns, which you’re likely to experience from time to time.

On the other hand, as you grow older, you may want to reduce your exposure to risk and preserve your account value by shifting some assets from more risky to less risky investments. But it’s often a good idea to continue to hold stock funds, since the growth they can provide is one way to replenish the amounts you withdraw. It’s also a way to help ensure that you don’t outlive your money.

CONTRIBUTION POWER

If you contribute as little as 1% of base pay to your TSP account, you’re entitled to contribute up to 100% of any special, incentive, or bonus pay you receive, including all or part of your career continuation pay. There’s no DoD match for these contributions, but the cash infusions increase the balance on which earnings can accumulate.

Special rules apply to tax-free combat pay deposited to your TSP account. If the money goes into a tax-deferred account, the contribution will be tax free when you withdraw. But earnings on the contribution are tax deferred, so they’ll be taxed as you withdraw them. However, if you deposit the money into a Roth account, both the contribution and earnings on the contribution are tax free at withdrawal.

If you contribute combat pay, though, you’ll probably want to consult an experienced tax adviser to ensure that your contributions don’t exceed the legal limit and that you report withdrawals correctly when you file your tax return.

Go to the calculator:

Long-Term Return